mPBZCOM app for iPhone and iPad

Developer: Asseco South Eastern Europe

First release : 21 Oct 2013

App size: 7.61 Mb

mPBZCOM usluga mobilnog bankarstva za poslovne subjekte omogućuje Vam siguran pristup informacijama o PBZ proizvodima i uslugama čiji ste korisnik te obavljanje financijskih transakcija bilo kada i s bilo kojeg mjesta u svijetu gdje imate pristup Internetu s Vašeg mobilnog uređaja.

Uslugu možete ugovoriti na Vama najbližem PBZ Sinergo desku u PBZ Poslovnim centrima/Poslovnicama. Prilikom ugovaranja usluge dobit ćete identifikator i inicijalnu lozinku, što Vam je potrebno za aktivaciju mPBZCOM usluge.

Karakteristike i funkcionalnosti mPBZCOM usluge

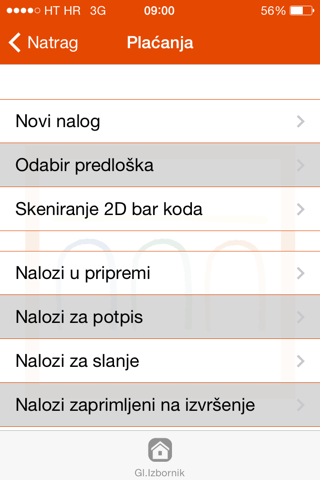

Putem mPBZCOM usluge mobilnog bankarstva imate potpunu kontrolu nad svojim transakcijskim računima i plaćanjima, a omogućene su Vam i sljedeće funkcionalnosti:

• pregled stanja, prometa i dnevnog izvještaja po transakcijskim računima

(za kunsku i deviznu komponentu)

• formiranje plaćanja (nacionalna plaćanja u kunama) sukladno dodijeljenim ovlaštenjima

• formiranje naloga iz predložaka

• skeniranje uplatnica s otisnutim 2D bar kodom

• pregled naloga po pretincima sukladno ovlaštenjima

• mogućnost slanja PDF potvrde za svako plaćanje na željenu e-mail adresu

• uvid u dospjele obveze s mogućnošću plaćanja

• kupnja, prodaja i konverzija deviza po redovnom tečaju

• pregled tečajne liste

• pristup kontakt podacima (kontakt osoba, telefon, e-mail, web)

• primanje informacija i obavijesti

• pregled troškova po American Express karticama

• lokacijske usluge

Sigurnost

Korištenje mPBZCOM aplikacije potpuno je sigurno, što je potvrđeno i certifikatom za sigurnost ISO 27001:2005.

mPBZCOM aplikacija koristi se pomoću PIN-a kojega zna samo korisnik te, u slučaju krađe ili gubitka mobitela, ne može doći do zlouporabe. Svi podaci vezani uz račune i PIN ne pohranjuju se na mobitel, čime je zajamčena apsolutna tajnost podataka. Aplikacija se zaključava nakon tri uzastopna unosa pogrešnog PIN-a te je time dodatno osigurana od neželjenog pristupa.

The mPBZCOM mobile banking service for corporate clients ensures a safe approach to information on PBZ products and services that you use, as well as performing financial transactions anytime and anywhere in the world where you have access to the internet from your iPhone.

You can contract the service at your closest PBZ Sinergo desk at PBZ business centres / branch offices. When contracting the service, you will get an identification and an initial password, which you will require for the activation of the mPBZCOM service.

Characteristics and functionalities of the mPBZCOM service

Through the mPBZCOM mobile banking service, you have complete control over your transactions, accounts and payments; the following functionalities are also enabled:

•Overview of status, transactions and the daily report by transaction account

(for the HRK and foreign currency component)

•Making payments (national payments in HRK) pursuant to the awarded authorisations

•Making orders using templates

•Scanning payment orders with a printed 2D bar code

•The survey of orders by folder pursuant to authorisations

•Possibilities of sending PDF receipts for each payment to the desired e-mail address

•Insight into due obligations with the possibility of payment

•The purchase, sale and conversion of foreign exchange according to the regular exchange rate

•A survey of the exchange rate

•Access to contact data (contact person, phone, e-mail, web)

•Receiving information and notifications

•Review of American Express card expenses

•Location services

Security

The use of the mPBZCOM application is completely secure, which has been confirmed by the ISO 27001:2005 security certificate.

The mPBZCOM application is used by means of a PIN that is known only to the user and there can be no abuse in the case of the theft or loss of the cell phone. The data related to the accounts and the PIN are not stored on the cell phone, which guarantees complete data secrecy. The application is locked after three consecutive wrong PIN entries and is thus additionally protected against unwanted access.